September turned out to be a very positive month in what is historically a weak period. This strong performance is even more remarkable given that stock market valuations are at record highs.

In the case of fixed income, the increases reflected investor optimism ahead of the upcoming Federal Reserve (Fed) meeting and expectations of a possible rate cut.

- S&P 500: +3.53%.

- Nasdaq: +5.40%.

- Stoxx Europe: +1.46%.

- All Country World Index EUR: +2.91% (the dollar fell 0.20%, the dollar index rose 3.49%).

- Global fixed income index EUR: +0.27% (the dollar fell 0.20%, the dollar index rose 0.54%).

The market has maintained its upward trend since April’s lows, driven once again by US tech giants. More and more voices are saying that the market is overvalued and even in bubble mode, and that there will soon be a correction that will erode gains. Are they right?

Before answering this question, it is worth reviewing the general reasons behind stock market rises. I humbly offer the following, although others may add more or disagree with these:

- Positive Economic Situation

Gross Domestic Product (GDP) is the most common benchmark for assessing a country’s economic activity. Personally, I find it unrealistic to try to encapsulate this reality in a single figure, which can also lead to misleading interpretations, but it is the most widely used indicator. GDP is calculated as follows:

GDP = C + I + G + (X – M)

Where:

C = Consumption

I = Investment in goods and services

G = Government spending

X-M = Exports-Imports (The so-called external sector)

All these variables can rise and fall, but if the net result is positive, it indicates that economic activity is expanding. The variable that carries the most weight in most countries is consumption. For this reason, many economists known as Keynesians propose policies aimed at stimulating consumption, such as making credit cheaper or increasing public spending.

In times of crisis, when both consumption and investment stagnate, the public sector tends to increase spending (G) to compensate. However, this approach carries an obvious risk: the waste of public money, which, let’s not forget, is our money. An extreme example is provided by the Soviet system implemented in the late 1920s under Stalin’s leadership. This model was guided by planned production targets, not by the actual production needs of the market. If the five-year plan set a target of producing 10 million tons of steel, the factories did so, even if there was no immediate use for so much steel. Success was measured by “fulfilling the plan,” not by the usefulness or profit of the product. One of the consequences of these plans was the environmental disaster caused in the Aral Sea, [1]one of the greatest in contemporary history.

It is true that I have given an extreme example, but today there is still an incentive or “temptation” on the part of governments to manipulate public spending in order to appear to be in good financial health. That is why I insist: GDP can be misleading if it is not interpreted with caution.

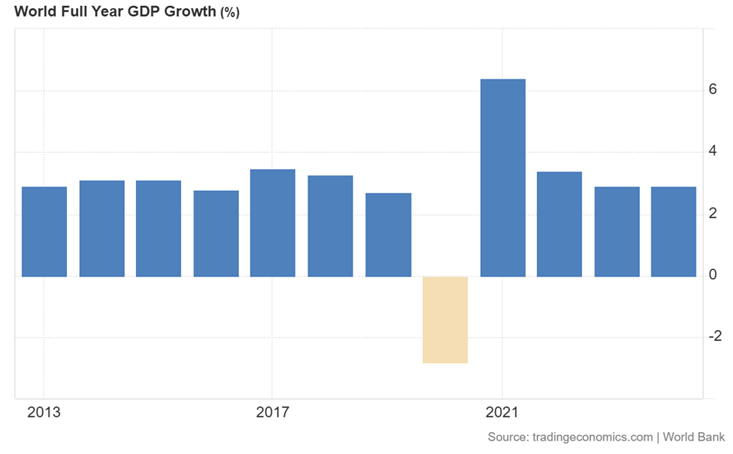

That said, how is the global economy doing? According to the latest data, global growth stands at around 2.9%, with a more or less stable trend. The United States, with growth of 3.8%, accounts for approximately 35% of the total increase.

In summary, the economy is growing, albeit in a fragile manner: the momentum comes mainly from consumption, often sustained by credit, which may prove detrimental in the long run, while investment, which is key to future growth, continues to decline.

2. Corporate Earnings.

The share price reflects expectations about a company’s future earnings. It is therefore an estimate of the future, which always introduces some uncertainty as to whether those forecasts will be fulfilled or not. Because it is based on projections, the price that investors assign to a company is ultimately subjective, which is why equities tend to be more volatile.

Currently, there is widespread optimism about the new paradigm of Artificial Intelligence (AI), which is reflected in valuation multiples that, as we have said on previous occasions, are very demanding. AI-related companies continue to post spectacular profits, although the market is already discounting an almost perfect scenario; in other words, growth will have to remain high for quite some time to justify current prices.

But does this mean that if these “AI companies,” represented by the Magnificent 7 (M7), grow, the rest of the market will grow too?

According to Facset data, the M7s show growth of 14.3%, compared to 3.4% for the rest of the S&P 500. Therefore, a slowdown in the M7s will have a direct impact on the index’s valuation. Today, they continue to lead the rise and pull the rest of the market along with them.

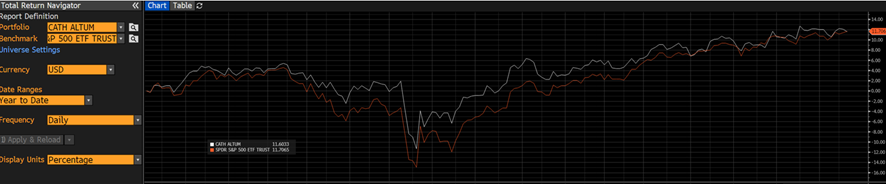

Does this mean that if we do not invest in the M7, we will miss out on the stock market rally? Not necessarily. This Bloomberg chart compares the performance of the S&P index so far this year (orange) with the same filtered index, which excludes companies whose operations and practices conflict with the Social Doctrine of the Church. The result shows that profitability is not lower. There are still high-quality companies outside these M7 stocks, and at much more reasonable prices.

Source: Bloomberg.

In conclusion, profits are accompanying the upward trend, although in some cases they are underpinned by considerable optimism, perhaps excessive, on the part of the mega tech companies.

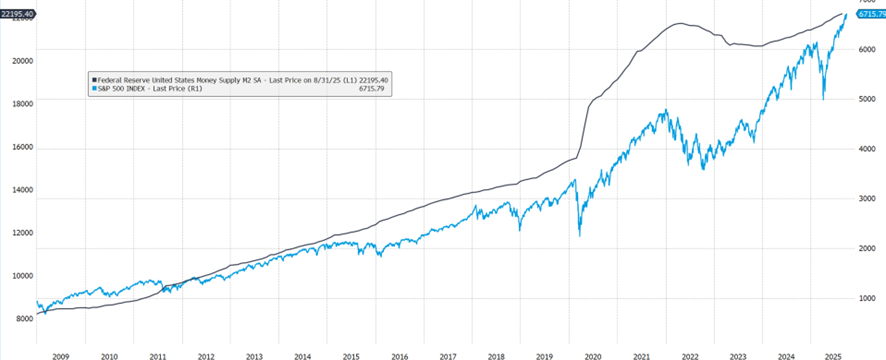

3. Liquidity

According to some studies, in the short term, what drives the market is available liquidity. In periods when central banks have injected liquidity into the system, stock markets have tended to rise, as shown in the graph. The dark blue line represents the money supply (money printing, or the amount of money in circulation) called M2, and the light blue line corresponds to the S&P 500. The correlation between the two is almost perfect.

Source: Own elaboration, Bloomberg.

This seems like good news, right? In part, yes, but it depends: an injection of liquidity above the real needs of the economy can lead to speculative bubbles and/or inflation. Therefore, in the short term it is very positive, but it is also important to analyze the long-term consequences.

4. Optimism in the face of interest rate cuts.

This month saw confirmation of the interest rate cut in the United States, a decision eagerly awaited by investors, which has driven the subsequent rise in the stock markets.

But why is an interest rate cut usually good news for the stock market? There are several reasons, of which I would highlight two in particular:

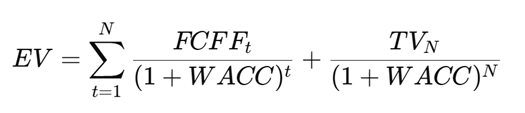

- First: Financial assets are valued, in most cases, by discounting future cash flows using a formula that is:

Oh my goodness, what is that? Don’t worry, I’m not going to go into detail explaining all the elements that appear, but I would like to highlight what is in the denominator: the WACC (Weighted Average Cost of Capital). This is the rate at which cash flows are discounted and is closely correlated with official interest rates. Therefore, if these fall, the WACC is also likely to fall and, as a result, the value of the asset (EV) will increase.

- Second: Lower interest rates reduce companies’ financial costs, which will have a direct impact on their income statements.

But beware, not everything has to be positive. Every action has its consequences, and an excessive drop in interest rates can lead to bad investments and future crises.

It therefore seems that the above factors—economic growth, corporate profits, abundant liquidity, and optimism about rate cuts—are the cause of the rise in the stock markets, but it is very important to analyze each of them, because they could be “the devil dressed as a being of light.”

Risks and contradictions of lowering interest rates.

- Does lowering interest rates make sense? When the central bank decides to lower interest rates, it does so to stimulate the economy in times of weakness. However, the current context is as follows:

- Stocks at record highs.

- Real estate prices at record highs.

- Gold at record highs.

- Money supply at record highs.

- Government debt at record highs.

- Inflation above the central bank’s target.

Given this scenario, it is difficult to understand the need to lower interest rates. Or perhaps there is something we are not seeing?

2. Stagflation

A drop in interest rates accompanied by excessive liquidity injections could lead to stagflation, i.e., economic stagnation with high inflation. This is not a likely scenario, but we must remain alert to any signs in this direction.

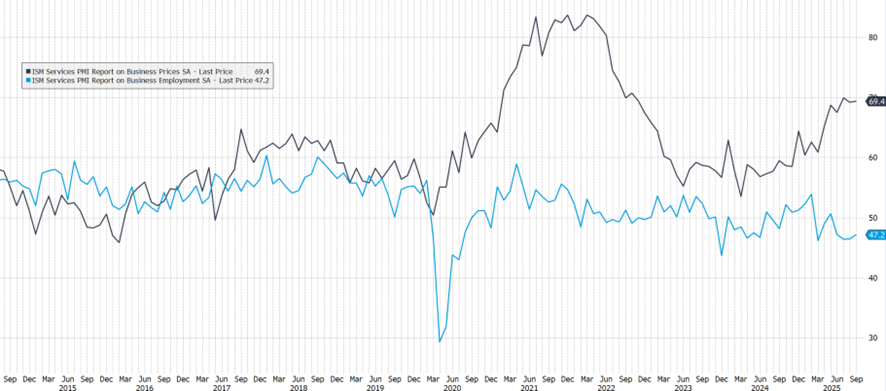

The dark blue line in the graph represents surveys of service companies regarding prices, and the light blue line represents surveys regarding employment. Prices are rising sharply while employment is weakening.

Is this what the FED is observing? Surely, and its justification for lowering interest rates seems to be the fall in employment, even at the cost of accepting higher inflation…

Source: Own elaboration, Bloomberg.

But is this really a technical decision by the central bank or interference by the Trump administration, which is interested in keeping rates low to help maintain the country’s deficit?

Finally, there has been an unusual event in the US administration: a government shutdown, with all the implications that this entails.

The start of fiscal year 2026 was scheduled for October 1, 2025, and before that date, Congress had to approve the budgets for the various agencies. However, a continuation agreement was not reached in time.

The main causes of the dispute include:

- The level of federal spending (defense, social programs, etc.).

- The continuation of certain health subsidies (e.g., tax credits under the Affordable Care Act) and their funding.

- Disagreements over cuts or termination of foreign aid, as well as possible changes in fiscal policy.

- Growing political polarization (Republicans vs. Democrats), which makes it difficult to obtain the 60 votes needed in the Senate to pass certain proposals.

With the deadline passing without consensus, many agencies were left without available funds, which has had significant consequences:

- An estimated 803,000 federal employees have been temporarily furloughed, in addition to hundreds of thousands more who continue to work without immediate pay.

- According to analysts, each week of shutdown could cost between $7 billion and $15 billion to the U.S. GDP, depending on the duration and scope of the shutdown.

- Key economic data, such as the monthly employment report, has been delayed due to the government shutdown.

- Negotiations between Democrats and Republicans continue, with mutual accusations of unwillingness to compromise. The main point of contention remains the funding of health subsidies and budget cuts demanded by the more conservative Republican wing.

Jesus said, “The truth will set you free,” and I’m not going to argue with him. In the world we live in, knowing the truth, or at least having an interest in knowing it, is essential for exercising good judgment and freedom. In the world of investing, it’s key, which is why we need to learn or at least put ourselves in the hands of those who know what they’re doing so they can help us.

If we see investing as a means to get rich quickly, we are more likely to end up getting caught up in some scam, but if we invest so that our assets continue to cover our needs and those of our loved ones, then it is essential to discern what to do with them.

[1] Mar de Aral: los desastres medioambientales de la Unión Soviética