August, in absolute terms, left a positive balance with some signs of prudence and, if we look a little more in depth, a certain concern.

- S&P 500: +2.03%.

- Nasdaq: +0.92%.

- Stoxx Europe: +0.96%.

- All Country World Index EUR: -0.36% (the dollar fell by 2.38%, the index in dollars rose by 2.52%).

- Global fixed-income index EUR: -0.80% (the dollar fell by 2.38%, the index in dollars rose by 0.35%).

Both equities and fixed income rose in general terms thanks to growing hopes of rate cuts by the Fed in September. On the other hand, a certain caution is perceived because valuations are at highs, above the historical average; structural risks persist such as the uncertainty generated by U.S. tariffs, high public debt, an upward trend in fiscal deficits that is reflected in the rise of the risk premium offered by the longest maturities of government debt, mixed economic data, and very stubborn inflation in returning to central banks’ 2% target.

But well, markets keep going up, don’t they? True, although I think it’s related to what I mentioned in last month’s analysis: the fear of a resurgence in inflation due to various circumstances is leading many investors to replace cash—which is losing value by the day—with assets that can preserve or even increase their value. Among these, gold stands out, as do shares of companies with solid balance sheets and real assets, and even bitcoin.

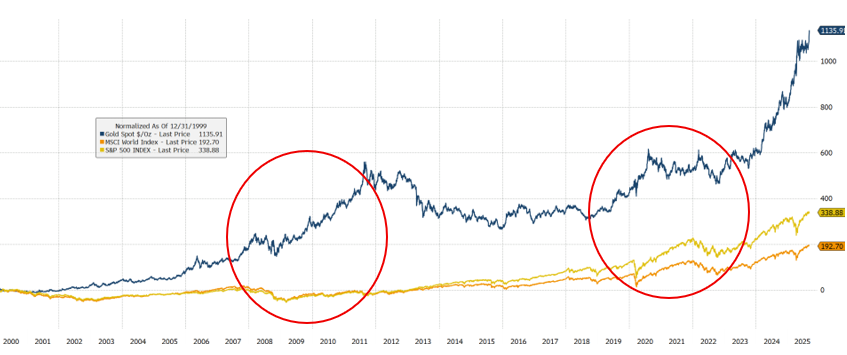

Historically, the correlation between gold and equities has been slightly negative. That is, when equities fall, gold tends to rise, and vice versa, as can be seen in this chart. This is because, in periods of crisis, investors tend to seek safe-haven assets, with gold being the most traditional and recognized of them.

Source: Bloomberg

However, this year—and especially after the market drop caused by Trump’s tariff announcements—the correlation between gold and equities has been positive. That is, both assets have risen at the same time. In the lower chart, which is the same as the previous one but focused on the current period, the red line marks the low that the market (represented by the orange and yellow lines) set after the tariff announcement. As has happened historically, at the moment of greatest uncertainty gold reacted to the upside. But interestingly, from that red line onward, both gold and equities have risen simultaneously. What happened?

Source: Bloomberg

If we add what is happening with long-term government bonds, we can better understand this situation. As I mentioned before, equities have performed well, driven by optimism about a possible rate cut by the Fed, fueled by weaker-than-expected employment data.

Upside-down world? Is bad data good data? Well, yes, because the weaker the data, the more arguments the Fed has to justify a rate cut at its next meeting in September—and happiness for shorter-term investors.

Do I like it? Not particularly. Although it can stimulate markets in the short term, I believe that in the long term it creates deeper distortions, especially in capital allocation and in the perception of risk.

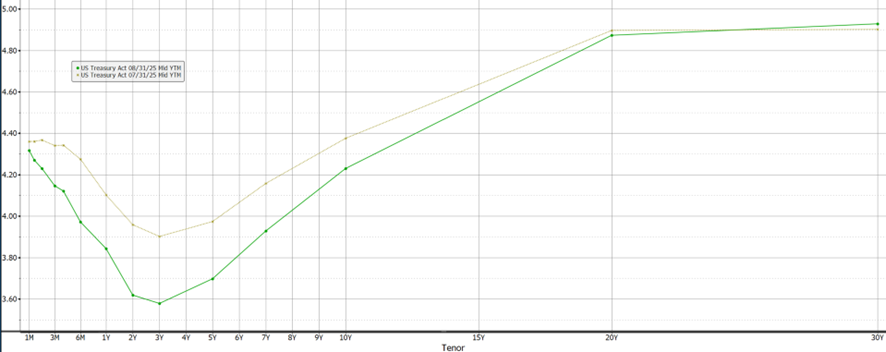

This chart shows U.S. bond interest rates at different maturities (the famous yield curve). The brown line shows how the curve looked on 07/31/2025 and the green one on 08/31/2025.

Source: Bloomberg

As a consequence of the higher probability of rate cuts, the yields on shorter maturities have fallen. However, longer-term yields, such as 15- and 20-year, have fallen only very slightly or even risen, as is the case with 30-year bonds.

How is it possible that, with a higher likelihood of rate cuts, these yields fall so little or even rise?

The key is that the Fed controls very short-term interest rates, but long-term rates depend on supply and demand in the market—that is, on investor appetite. And what we are seeing is that such an appetite for long-term bonds is not present.

Why? This is one of the big questions. Investors seem to be worried about several factors: the growing trend in the fiscal deficit, the increase in public debt to finance that deficit, the crowding-out effect (which makes access to credit more difficult for the private sector due to higher rates), and the impact all this may have on inflation in the future.

The immediate question would be: isn’t inflation already close to 2%, which is the Fed’s target?

Apparently, yes. It seems to finally be under control. However, besides the fact that it has stayed above 2% since February 2021, the process of a growing fiscal deficit is an important factor that can continue to fuel inflation.

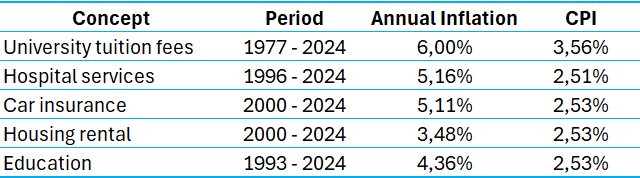

Before sharing my view, it is worth remembering that the official inflation figure is an aggregate average of goods and services that a group of experts considers representative of society. So far, so good. But since it is an average constructed by a group of people, who guarantees that the selected products truly reflect the consumption of the majority?

This table shows a series of common goods and services in the United States that people tend to consume in their day-to-day lives. As can be seen, their prices are well above that “desired” 2%.[1]

Source: BLS

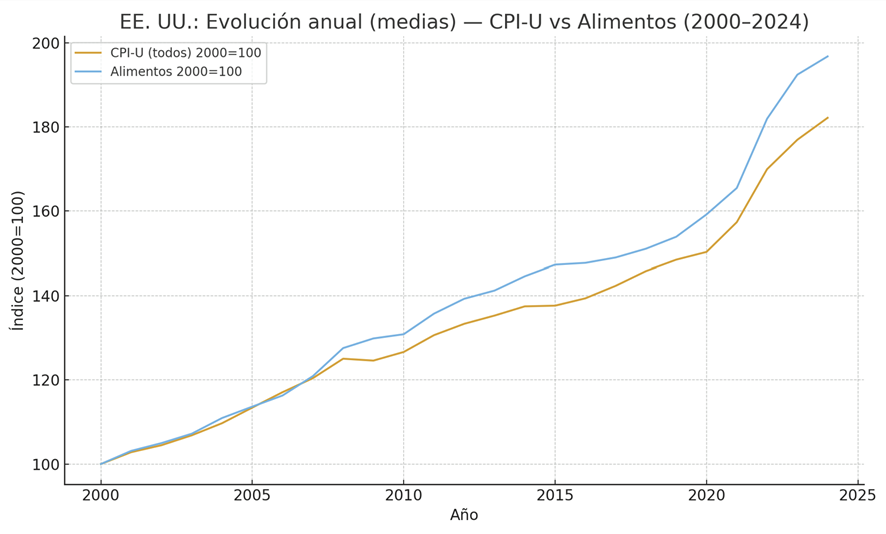

With respect to food, the evolution of food prices has been higher than the overall index.

In the chart, you can see jumps in prices in 2009 and in 2020, coinciding with the crises of those years. What happened?

The Fed, with the goal of supporting the private sector, began to increase the money supply—that is, it printed money to buy assets deteriorated by the crisis and to purchase Treasury debt, thus allowing an increase in social spending.

But of course, printing too much money entails risks, and the most important—and dangerous—of them is inflation.

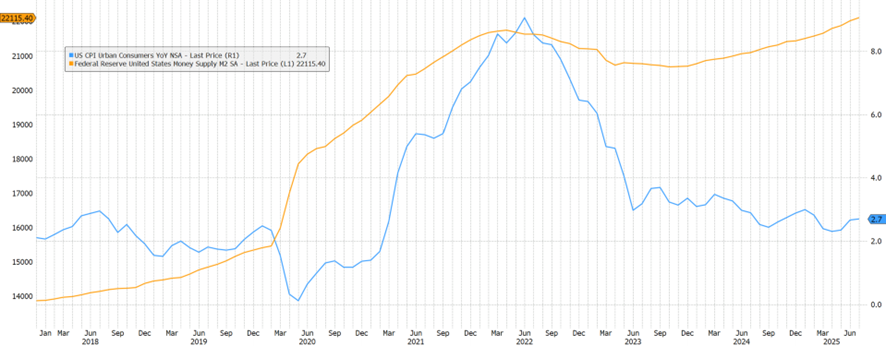

In the following chart, you can see how, starting in 2020, the money supply (M2) increased very strongly, with the intention of helping families and companies during the COVID-19 pandemic. However, the side effect was a rise in inflation to very high levels.

Source: Bloomberg

Subsequently, the Fed began to lower interest rates, which made it possible to control inflation, at least in the short term. However, if we look at the chart, the money supply—far from decreasing—has taken on new upward momentum.

Once the money supply is increased, reducing it becomes very difficult. It is the “drug” that generates the most addiction among politicians: more spending… and more votes?

We have already mentioned how Trump is pressuring Powell to lower rates, with the aim of reducing the government’s financial cost (that is, the cost of debt) and thus being able to finance the growing fiscal deficit more comfortably. This pressure represents an intrusion into an institution that, in theory, should be independent, namely the central bank. But the truth is that it stopped being so years ago. Today, the Fed is the largest buyer of U.S. debt. And to be able to acquire that debt, it needs to print money, which is a necessary—though not sufficient—condition for generating inflation.

The scheme of what is called deficit monetization is as follows:

- The Treasury spends more than it takes in → issues bonds.

- The central bank buys those bonds (or promises to buy them if necessary) → creates money supply to pay for them.

- More money supply → more bank credit available → higher money supply (greater liquidity in the system) → inflationary pressure.

For me, this is the big problem. The rise in government debt interest rates reflects that investors perceive high uncertainty about the future: slower growth and higher inflation

And this is not happening only in the United States; it is even more serious in other countries, as is the case of France. On Monday the 8th it faces a vote of confidence to obtain parliamentary backing for its fiscal program and to unblock the budget due to having a deficit of 5.8%, far from the 3% required by the EU; debt of 106% of GDP and rising; political uncertainty with an uptick in its risk premium of 0.80%; public spending of 57% of GDP; and weak growth.

With this clarification, the correlated rise of equities, gold and even bitcoin as alternatives to cash makes sense. Gold, by itself, is already a traditional substitute for liquidity: it has proven to maintain its value and to rise in times of uncertainty, because investors sell their banknotes, which are worth less and less, and buy gold, which is worth more and more.

Equities, for their part, represent companies with real assets that, if well managed, not only preserve their value but also increase it over time. That is why it is so important to understand well the businesses one invests in and to know the managers who lead them, to ensure they make the best use of those assets.

Investing, in my humble opinion, has become a search for shelter from political power.

As long as States have the common good as their objective and are governed by the principles of subsidiarity and solidarity, it is legitimate for them to obtain income through taxes to cover those needs. But one may ask: is that common good and those principles so great as to justify a gigantic state, financed through unlimited taxes and debt?

Investment offers us independence and freedom.

For more Market Reviews, click here.

[1] The CPI column indicates annual inflation in the corresponding periods calculated using the CPI index.